Black Gold Reset: How Venezuela’s 303 Billion Barrels Could Reshape Global Oil Markets Under a US-Led Operational Overhaul

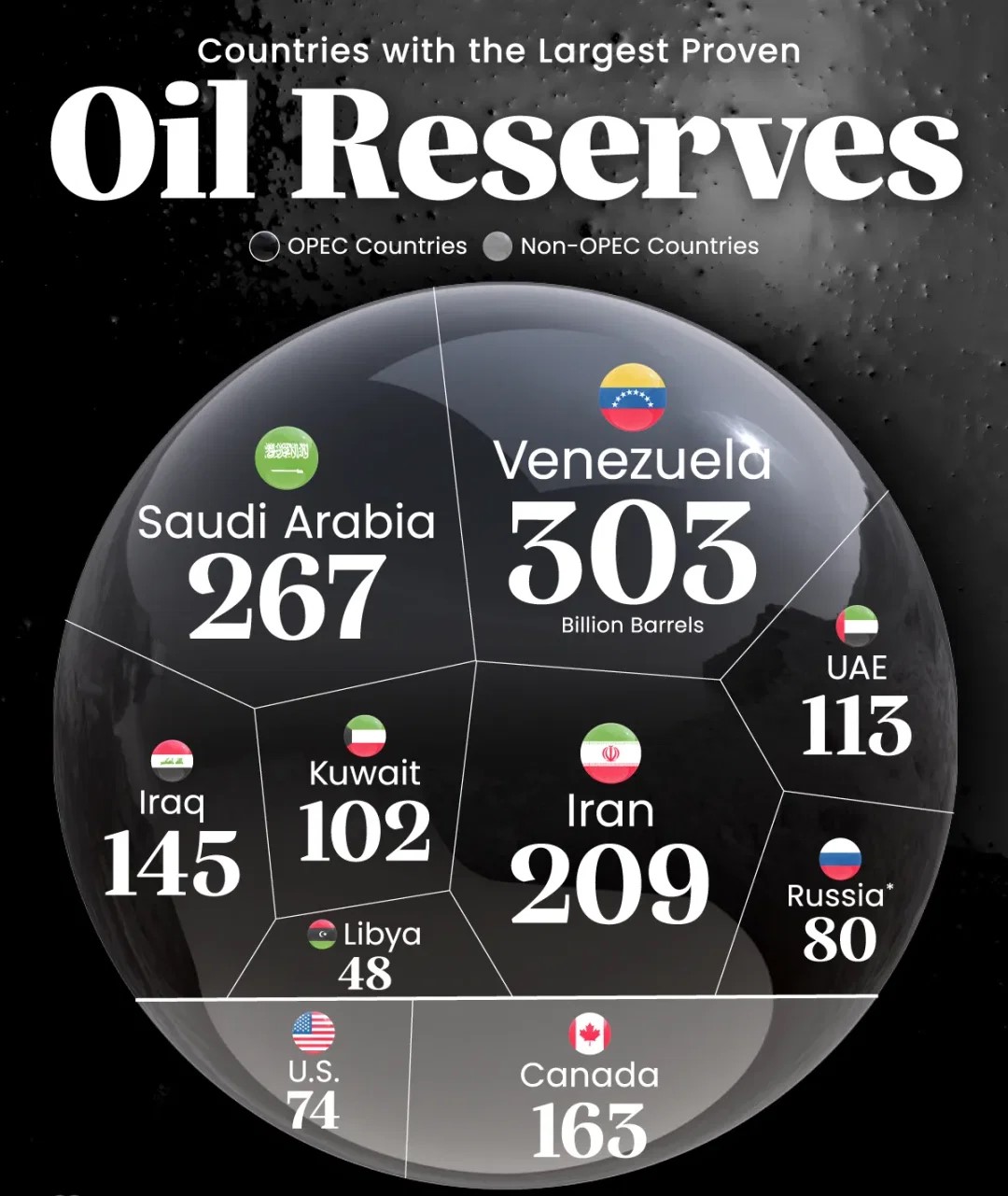

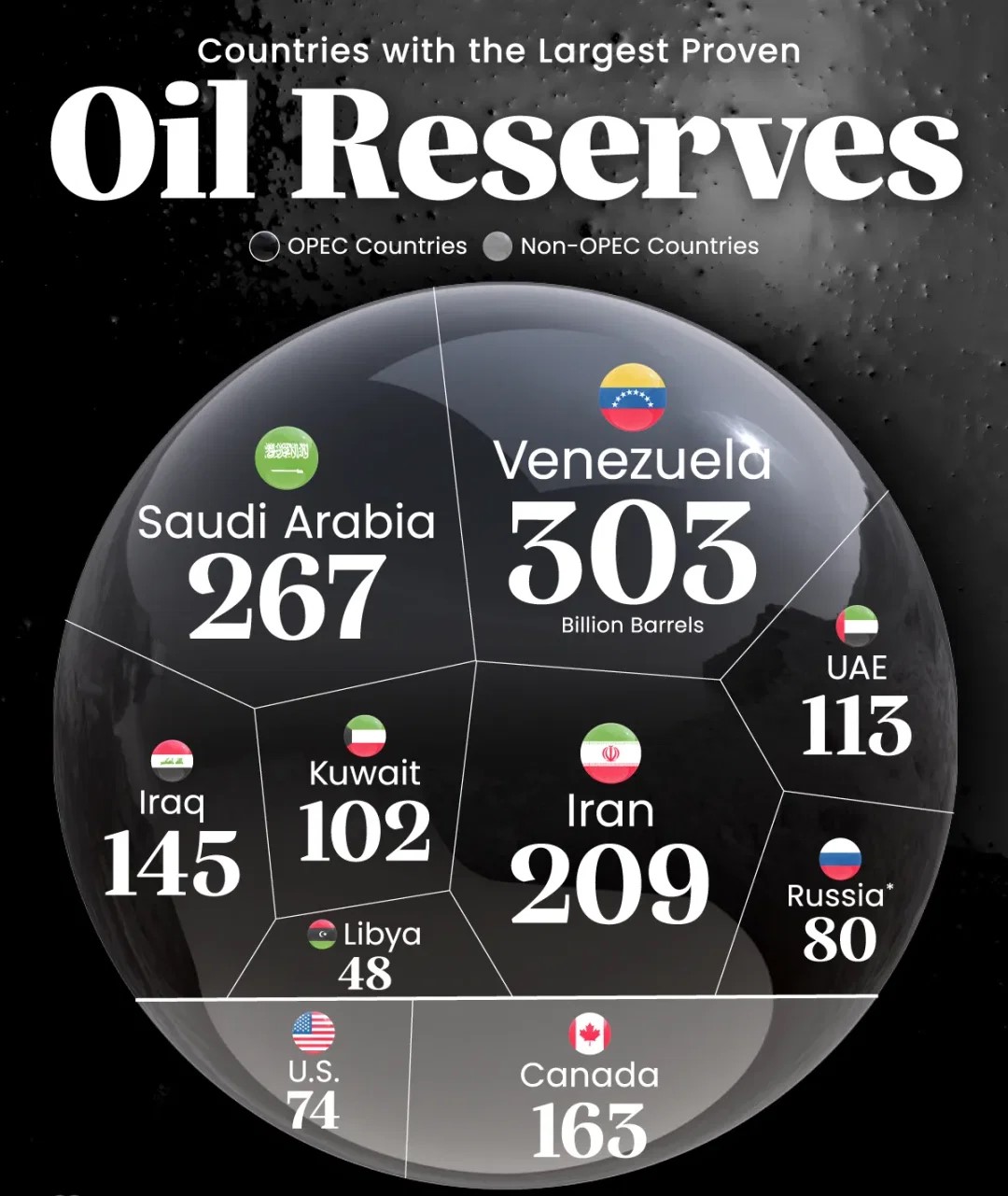

Venezuela holds 303 billion barrels of proven oil reserves, the largest concentration of oil on the planet—well ahead of Saudi Arabia (267 billion barrels), Iran (209 billion), Iraq (145 billion), and Canada (163 billion). Yet despite this extraordinary resource base, Venezuela has remained one of the most underperforming oil producers globally. The disconnect between resource ownership and revenue generation makes Venezuela a unique case where operational control, technology, and geopolitics matter more than geology.

A hypothetical US takeover or restructuring of Venezuela’s oil operations and infrastructure would represent one of the most consequential shifts in modern energy history.

Unlocking Venezuela’s Oil Revenue Potential

Under a US-led operational restructuring—focused on technology infusion, capital access, sanctions normalization, and infrastructure rehabilitation—Venezuela’s oil sector could move from stagnation to scale:

—Production recovery: From sub-1 million bpd levels toward 3–4 million bpd over 5–7 years

—Revenue upside: At $70/barrel, 3.5 million bpd translates to ~$90 billion annually, rivaling Iraq and approaching Saudi-tier revenues

—Cost optimization: US shale expertise and enhanced oil recovery (EOR) techniques could drastically lower Venezuela’s heavy-oil breakeven costs

Given that Venezuela’s reserves are nearly 4× larger than the U.S. (74 bn barrels) and significantly above Russia (80 bn barrels), even partial monetization would reposition it among the top three global oil revenue generators.

Opportunities for Oil Companies Across Regions

North America

US oil majors and service companies would gain access to some of the world’s longest-life reserves, balancing short-cycle shale assets. Gulf Coast refiners—already configured for heavy crude—would benefit from stable feedstock supply, while midstream players would see major investment opportunities in pipelines, export terminals, and storage.

Europe

European energy companies would secure diversification away from Middle Eastern and Russian supply risks. Large-scale upstream redevelopment, offshore services, and EPC contracts could unlock billions in capital deployment. Trading houses would gain a powerful new Atlantic Basin supply source, reshaping crude flows into Europe.

Asia

Asian national oil companies, particularly from China, India, Japan, and South Korea, would pursue long-term offtake agreements and equity stakes. For Asia, Venezuelan crude represents supply security and pricing leverage, reducing overdependence on Gulf producers.

A Structural Shift in Global Oil Trade

A revitalized Venezuelan oil sector would significantly alter global trade patterns

—Stronger Atlantic Basin supply dominance, easing pressure on Middle Eastern exporters

—Reduced market power concentration among a small group of producers

—Rebalancing within OPEC as Venezuela reasserts itself as a strategic heavyweight

This shift would also reduce reliance on higher-cost or geopolitically constrained producers.

The Bigger Picture

Venezuela’s oil story is no longer about reserves alone—it is about who can unlock them efficiently. If US-led operational control and infrastructure modernization were to materialize, Venezuela could rapidly transition from a marginal producer into a central pillar of global oil supply. Such a shift would redefine investment flows, reshape trade routes, and recalibrate oil pricing power worldwide. In an era where energy security is once again a strategic priority, Venezuela represents the largest untapped oil opportunity in the global energy system.

For Deeper, Data-Driven Insights

For stakeholders seeking quantitative forecasts, scenario modeling, and investment-grade analysis on Venezuela’s oil potential and its global implications, Novatrends Market Intelligence offers detailed and accurate market intelligence. Our reports cover production ramp-up scenarios, price sensitivity analysis, regional trade flow shifts, company-level opportunity mapping, and long-term supply–demand forecasts across North America, Europe, and Asia. Backed by robust data models and industry expertise, Novatrends Market Intelligence helps decision-makers evaluate risks, returns, and timing with clarity in a rapidly evolving global oil landscape.

Aerospace & Defence

Aerospace & Defence

Agriculture

Agriculture

Automotive

Automotive

Building & Construction

Building & Construction

Chemicals

Chemicals

Digital Technologies

Digital Technologies

Energy & Power

Energy & Power

Equipment & Machinery

Equipment & Machinery

FMCG

FMCG

Hospitality & Tourism

Hospitality & Tourism

Metallurgy

Metallurgy

Oil & Gas

Retail Businesses

Retail Businesses

Materials

Materials

Banking & Financial Services

Banking & Financial Services

Electronics & Semiconductors

Electronics & Semiconductors

Healthcare & Pharmaceutical

Healthcare & Pharmaceutical

Packaging

Packaging