Market Overview

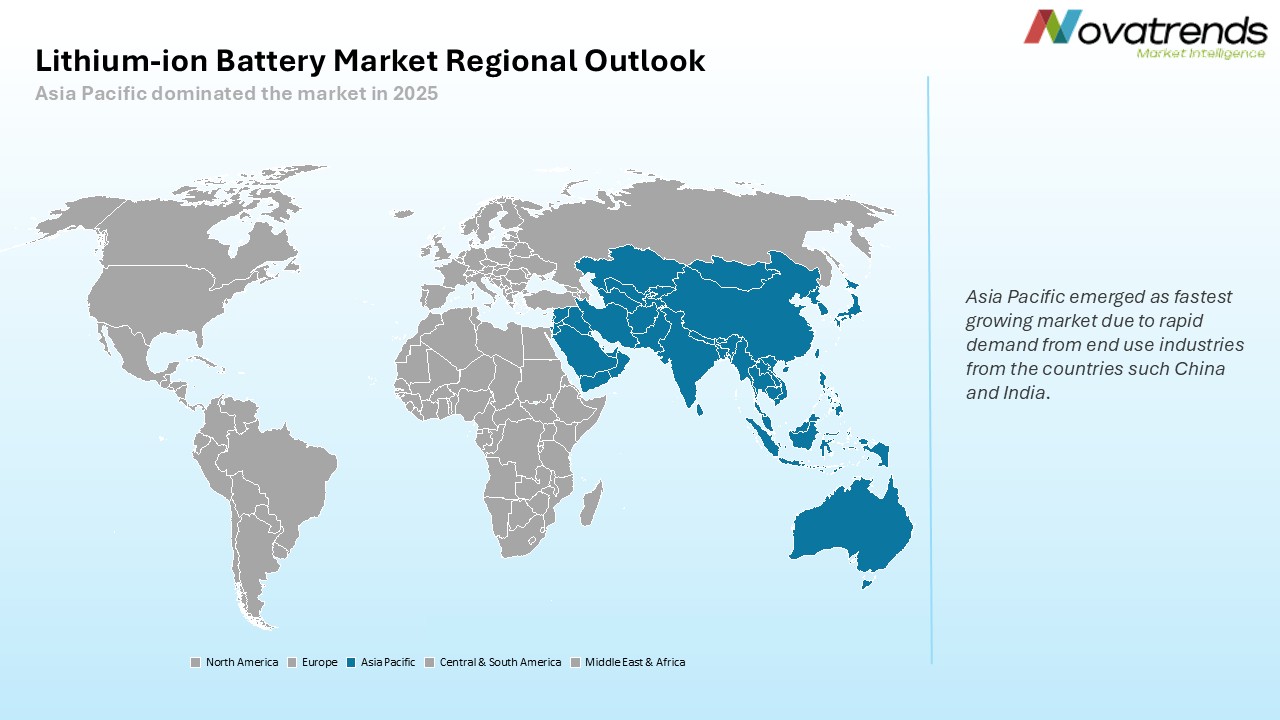

According to Novatrends Market Intelligence, the Global Lithium-ion Battery market as valued at USD 63.67 billion in 2025 and is anticipated to propel at a growth rate of 22.1% from 2026-2036, driven by Rapid adoption of electric vehicles, renewable energy integration, and expansion of consumer electronics manufacturing continue to drive demand. Lithium-ion batteries are preferred due to their high energy density, declining cost curve, and improving safety performance. Ongoing advancements in cathode chemistry, battery management systems, and manufacturing scale are strengthening market competitiveness. Asia Pacific remains the dominant production hub, while North America and Europe are accelerating domestic capacity development. Over the next decade, the market is expected to expand steadily, supported by decarbonization targets and electrification initiatives worldwide.

Market Dynamics

Growth is primarily driven by electric vehicle penetration, grid-scale energy storage deployment, and renewable power integration. In 2024, multiple global automakers expanded EV production targets, reinforcing long-term lithium-ion demand. Government incentives for clean mobility and energy storage further support adoption. However, supply chain volatility for lithium, nickel, and cobalt, along with rising environmental scrutiny, presents challenges. Safety incidents and recycling infrastructure gaps also restrain adoption in some regions. Opportunities are emerging through solid-state battery development, localized gigafactory investments, and second-life battery applications. In 2025, several battery manufacturers announced investments in recycling and closed-loop material recovery to reduce raw material dependence and enhance sustainability.

Segment Analysis

By battery type, lithium iron phosphate dominates cost-sensitive applications due to thermal stability and longer cycle life, while lithium nickel manganese cobalt chemistry leads in electric vehicles because of higher energy density. Lithium nickel cobalt aluminum is gaining traction in premium EVs, while lithium titanate serves niche fast-charging applications. By application, electric vehicles represent the largest and fastest-growing segment, supported by regulatory mandates and OEM commitments. Energy storage systems are expanding rapidly due to renewable integration needs. Consumer electronics maintain steady demand, while industrial applications benefit from automation and backup power requirements. Regional growth is strongest in Asia Pacific, driven by manufacturing scale and policy support.

Recent Developments in Lithium-ion Battery Market

- In July 2025, Panasonic Energy Co., Ltd. expanded its North American manufacturing operations by started its operations at its new lithium-ion battery manufacturing plant in De Soto, Kansas, U.S. This state-of-the-art plant focuses on the mass production of advanced 2,170 cylindrical lithium-ion battery cells designed for electric vehicle applications.

- In June 2025, Samsung SDI announced new supply agreements for high-performance lithium-ion batteries targeting premium electric vehicles and industrial energy storage systems, reflecting sustained demand growth across multiple end-use sectors.

- In March 2025, several European battery consortium members advanced joint initiatives to scale lithium-ion recycling infrastructure, addressing regulatory requirements and strengthening local supply chains for critical battery materials.

- In January 2025, Tesla disclosed continued investment in lithium-ion cell manufacturing optimization, emphasizing cost reduction, material efficiency, and higher output per gigafactory to support expanding electric vehicle and energy storage deployments.

- In February 2024, CATL announced expansion of its next-generation lithium-ion battery production lines, focusing on high-energy-density and long-life chemistries aimed at electric vehicles and grid storage, reinforcing its leadership in global battery manufacturing capacity.

- In May 2024, LG Energy Solution revealed plans to strengthen lithium-ion battery manufacturing in North America through capacity optimization and supply agreements with automakers, supporting regional EV production and reducing dependence on overseas battery imports.

- In August 2024, Panasonic Energy confirmed progress on advanced cylindrical lithium-ion battery development, targeting improved energy density and faster charging for electric vehicles, aligning with next-generation automotive performance requirements.

Top Lithium-ion Battery Market - Key Market Players

- CATL

- LG Energy Solution

- Panasonic Energy

- Samsung SDI

- BYD

- SK On

- CALB

- Envision AESC

- Gotion High-Tech

- Northvolt

- Toshiba Energy Systems

- EVE Energy

- Sunwoda

- Farasis Energy

Global Lithium-ion Battery Market Report- Scope (Customizable)

|

Scope |

Description |

|

Historic Period |

2021-2024 |

|

Base Year (Esti.) |

2025 |

|

Forecast Period (F) |

2026-2036 |

|

Market Values |

USD Million, Units |

|

Market by Type |

Lithium Iron Phosphate (LFP), Lithium Nickel Manganese Cobalt (NMC), Lithium Nickel Cobalt Aluminum (NCA), Lithium Titanate (LTO) |

|

Market by Application |

Electric Vehicles, Energy Storage Systems, Consumer Electronics, Industrial Equipment |

|

Market by End-Use |

Automotive, Energy and Utilities, Consumer Electronics, Industrial and Manufacturing, Aerospace and Defense |

|

Market by Region |

North America (NA), Europe (EUR), Asia Pacific (APAC), Central & South America (CSA), and Middle East & Africa (MEA) |

|

Countries Covered |

U.S., Canada, and Mexico; Germany, France, UK, Russia, Italy, Spain, and Netherlands; China, India, Japan, South Korea, and Australia; Brazil, Argentina; Saudi Arabia, UAE, Turkey, Egypt, and South Africa |

Detailed Market Segmentation

- By Type (Revenue in USD Million) (Volume in Units) (Capacity in GWh)

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Manganese Cobalt (NMC)

- Lithium Nickel Cobalt Aluminum (NCA)

- Lithium Titanate (LTO)

- By Application (Revenue in USD Million) (Volume in Units) (Capacity in GWh)

- Electric Vehicles

- Energy Storage Systems

- Consumer Electronics

- Industrial Equipment

- By End-Use (Revenue in USD Million) (Volume in Units) (Capacity in GWh)

- Automotive

- Energy and Utilities

- Consumer Electronics

- Industrial and Manufacturing

- Aerospace and Defense

- By Region (Revenue in USD Million) (Volume in Units) (Capacity in GWh)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Russia

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Central & South America

- Brazil

- Argentina

- Middle East and Africa

- Saudi Arabia

- UAE

- Turkey

- Egypt

- South Africa

- North America

GET A FREE SAMPLE

GET A FREE SAMPLE

Need a custom report?

Need a custom report?