Market Overview

According to Novatrends Market Intelligence, the global nickel cadmium (NiCd) battery market was valued at USD 1.40 billion in 2025 and is anticipated to propel at a growth rate of 3.2% from 2026-2036, driven by sustained demand for reliable and durable energy storage solutions in industrial applications such as railways, aviation, mining, and emergency power backup systems. The market continues to benefit from NiCd batteries’ ability to perform consistently under extreme temperatures, withstand deep discharge cycles, and offer long operational life with low maintenance requirements. Additionally, ongoing investments in infrastructure modernization, rising adoption of renewable energy systems requiring dependable backup power, and continued use of NiCd batteries in critical safety and mission-critical applications where lithium-ion alternatives face performance or safety limitations are further supporting market growth over the forecast period.

Market Dynamics

The Ni-Cd Battery market is primarily driven by consistent demand from aviation, railways, industrial backup power systems, and critical infrastructure due to the batteries’ high reliability, long service life, and ability to perform efficiently under extreme temperatures and harsh operating conditions. However, the market faces restraints such as stringent environmental regulations associated with cadmium toxicity, high compliance and recycling costs, and increasing substitution by alternative battery chemistries such as lithium-ion and nickel-metal hydride. Despite these challenges, the market presents meaningful opportunities through ongoing demand in safety-critical and mission-critical applications where Ni-Cd batteries remain the preferred choice, advancements in closed-loop recycling technologies to mitigate environmental impact, and continued investments in aviation, defense, and rail electrification projects. These factors collectively position the Ni-Cd Battery market for stable, niche-oriented growth as manufacturers and end users focus on regulatory compliance, sustainability initiatives, and performance optimization.

Segment Analysis

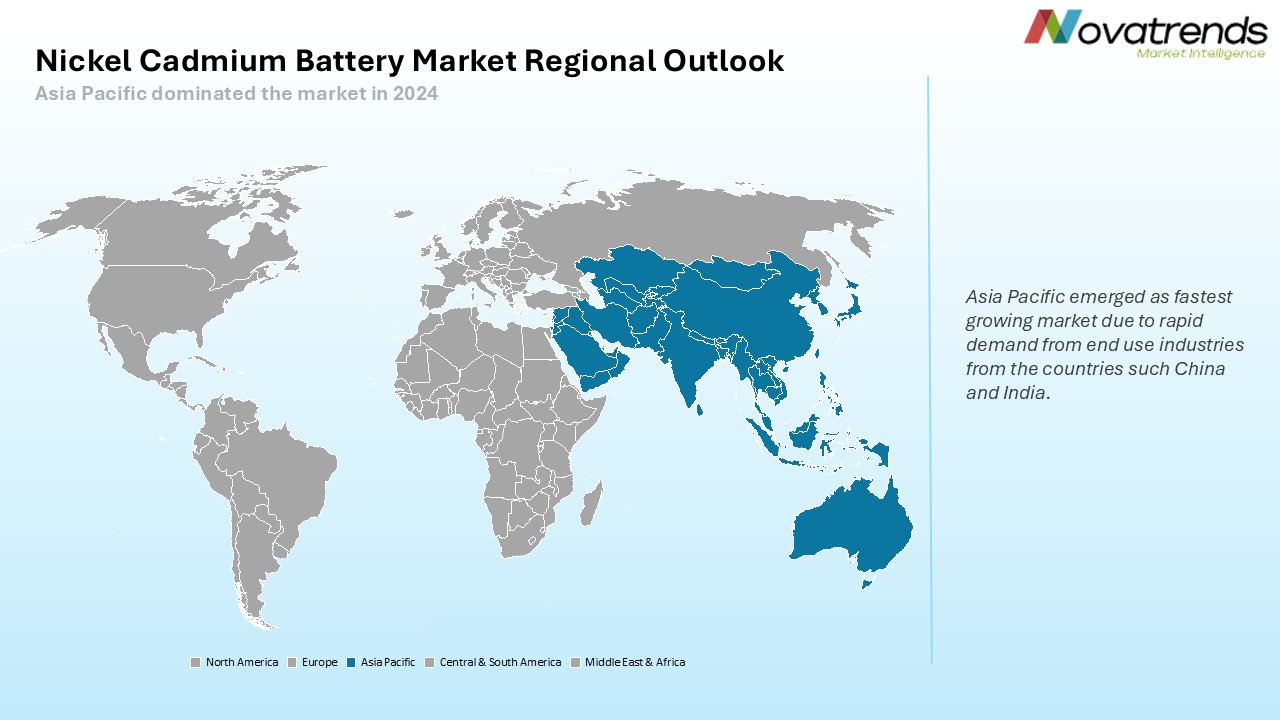

Vented Ni-Cd batteries dominated the global Ni-Cd Battery market in 2025 with an estimated 68% revenue share, supported by their proven reliability, robust performance in extreme temperatures, and widespread use in critical industrial environments, while the Above 500 Ah capacity segment led with a 48% share due to strong demand for high-capacity solutions in large-scale backup and standby power applications. Industrial Backup Power emerged as the leading application segment with a 38% revenue share, driven by the need for uninterrupted power supply across substations, data-critical facilities, and safety-critical infrastructure, whereas the Energy & Utilities sector dominated the end-use industry segment with a 33% share, reflecting continued investments in grid stability, renewable energy integration, and power reliability. OEM / Direct Sales accounted for the largest share of the distribution channel segment at 63%, as end users prefer direct procurement to ensure product quality, technical customization, and long-term service support. Although stringent environmental regulations related to cadmium usage, rising competition from lithium-ion batteries, and recycling compliance costs present challenges, Ni-Cd batteries continue to retain a strong foothold due to their long cycle life, high tolerance to electrical abuse, and dependable performance. Regionally, Asia Pacific dominated the market with emerged as dominating and fastest growing market driven by strong industrial base and large-scale manufacturing capabilities in asian countries such as China, Indonesia and India. Hence, such aspects are expected to foster market growth over the forecast period.

Recent Developments in Nickel Cadmium Battery Market

- March 2025 — Saft announced expansion of its industrial battery production capacity in Europe, including nickel-based systems, to support aviation and rail customers, strengthening regional supply resilience and reducing lead times for critical backup power projects.

- January 2025 — EnerSys introduced upgraded nickel-based battery solutions for rail and transit backup systems, focusing on extended lifecycle performance and lower maintenance intervals for signaling and control infrastructure.

- October 2024 — GS Yuasa reported new certification approvals for its aviation-grade NiCd batteries across additional aircraft platforms, enabling broader aftermarket supply and replacement opportunities in commercial and defense fleets.

- July 2024 — HBL Power Systems secured multiple international rail and metro battery supply contracts, including nickel cadmium configurations, supporting expansion of electrified rail corridors and safety systems.

- June 2024 — Saft partnered with a major aerospace maintenance provider to enhance lifecycle support programs for onboard NiCd batteries, improving monitoring, refurbishment, and recycling workflows.

- February 2024 — Several EU recycling operators launched upgraded cadmium recovery lines dedicated to industrial battery waste, increasing compliant recycling capacity and supporting circular material targets for nickel cadmium systems.

Top Nickel Cadmium Battery Market - Key Market Players

- Saft

- EnerSys

- Yuasa Corporation

- HBL Power Systems

- Alcad

- ALCAD A.B.

- Sichuan Changhong Battery

- Zhuhai Coslight Battery

- Hoppecke Batteries

- BYD Company

- VARTA AG

- Panasonic Energy

- Toshiba Battery

- Nilar International

- Power Sonic

Global Nickel Cadmium Battery Market Report- Scope (Customizable)

Scope

Description

Historic Period

2021-2024

Base Year (Esti.)

2025

Forecast Period (F)

2026-2036

Market Values

USD Million, Units

Market by Battery Type

Vented Nickel Cadmium Batteries, and Sealed Nickel Cadmium Batteries

Market by Capacity

Above 500 Ah, 100–500 Ah, and Below 100 Ah

Market by Application

Industrial Backup Power, Railways & Transportation, Aviation & Defense, Telecommunications, Renewable Energy, and Others

Market by End-Use Industry

Energy & Utilities, Transportation, Industrial Manufacturing, Telecom & Data Centers, and Defense & Healthcare

Market by Distribution Channel

OEM / Direct Sales, and Aftermarket / Replacement

Market by Region

North America (NA), Europe (EUR), Asia Pacific (APAC), Central & South America (CSA), and Middle East & Africa (MEA)

Countries Covered

U.S., Canada, and Mexico; Germany, France, UK, Russia, Italy, Spain, and Netherlands; China, India, Japan, South Korea, and Australia; Brazil, Argentina; Saudi Arabia, UAE, Turkey, Egypt, and South Africa

Detailed Market Segmentation

- By Battery Type (Revenue in USD Million) (Volume in Units)

- Vented Nickel Cadmium Batteries

- Sealed Nickel Cadmium Batteries

- By Capacity (Revenue in USD Million) (Volume in Units)

- Above 500 Ah

- 100–500 Ah

- Below 100 Ah

- By Application (Revenue in USD Million) (Volume in Units)

- Industrial Backup Power

- Railways & Transportation

- Aviation & Defense

- Telecommunications

- Renewable Energy

- Others

- By End-Use Industry (Revenue in USD Million) (Volume in Units)

- Energy & Utilities

- Transportation

- Industrial Manufacturing

- Telecom & Data Centers

- Defense & Healthcare

- By Distribution Channel (Revenue in USD Million) (Volume in Units)

- OEM / Direct Sales

- Aftermarket / Replacement

- By Region (Revenue in USD Million) (Volume in Units)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Russia

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Central & South America

- Brazil

- Argentina

- Middle East and Africa

- Saudi Arabia

- UAE

- Turkey

- Egypt

- South Africa

- North America

- By Battery Type (Revenue in USD Million) (Volume in Units)

GET A FREE SAMPLE

GET A FREE SAMPLE

Need a custom report?

Need a custom report?