Long Steel Products Market Overview

According to Novatrends Market Intelligence, the global long steel products market is valued at USD 728.31 billion in 2024. Long steel products, the workhorses of construction and infrastructure, are experiencing ever-increasing demand. This surge is fueled by a confluence of factors. The booming construction sector, driven by urbanization and population growth, requires vast quantities of steel for buildings and foundations. Similarly, government investments in infrastructure projects like bridges, railways, and smart cities are significant consumers of long steel.

Beyond these large-scale uses, the inherent advantages of long steel products like affordability, versatility, durability, and recyclability make them a compelling choice for a variety of applications. Additional demand comes from specific industries like automobiles and manufacturing, where long steel plays a crucial role in vehicle components and machinery.

International trade dynamics, with factors like trade liberalization and shifting production landscapes, can also influence demand. However, fluctuations in raw material prices and economic downturns can act as temporary brakes on this growth. Despite these potential challenges, the future for long steel products remains bright. Fueled by ongoing urbanization, infrastructure development, and their unique properties, long steel is poised to remain a vital building block for the modern world.

Long Steel Products Market Recent Developments

The long steel products market is anticipated to propel at a compounded annual growth rate (CAGR) of 4.57% from 2025-2032. The long steel products market is highly competitive due to the presence of major market players actively engaged in implementing strategic initiatives such as increasing investments, production expansion, enlarging distribution networks, and others. For instance,

- In July 2024, Tata Steel, an India-based steel producer announced its expansion of production capacity doubling to 40 million mt per annum, and will boost the domestic production to 75% of the total production.

- In February 2024, Tata Steel, announced the amalgamation of its 5 businesses including Tata Steel Mining Limited, Tata Steel Long Products, S&T Mining Company Limited, The Tinplate Company of India Limited, and Tata Metaliks Limited. This merger has been evaluated at a staggering amount of USD 390.1 million (Rs. 3,260 Cr.) and is anticipated to provide an opportunity for consolidation of the downstream operations.

Regional Overview

Asia Pacific dominated the global long steel products market in 2024 with a market revenue share of 66.00%. Asia Pacific is experiencing rapid urbanization, with megacities mushrooming and existing urban centers expanding at a breakneck pace. This translates to a massive requirement for residential and commercial buildings, all of which rely heavily on long steel products for reinforcement. Rebars, for instance, are crucial for building foundations, beams, and columns, ensuring the structural integrity of these towering structures.

Recognizing the vital role infrastructure plays in economic growth and improved quality of life, governments across Asia Pacific are ramping up investments. This translates to a flurry of activity, with new highways, bridges, and railways being constructed – all major consumers of long steel products. Similarly, congested cities are turning to metro systems, which rely heavily on long steel for tracks and stations. The rise of smart cities adds another layer to this demand. With a focus on sustainability and efficiency, these innovative urban centers are creating new opportunities for long steel products in areas like intelligent transportation systems and energy grids.

U.S. Long Steel Products Market Overview

The demand for long steel products in the U.S. is experiencing a welcome resurgence. This is fueled by a multi-pronged attack on infrastructure neglect. The Bipartisan Infrastructure Law is pumping money into transportation upgrades, public transit improvements, and clean energy infrastructure – all major consumers of long steel for construction projects.

Furthermore, a manufacturing renaissance is underway, with reshoring bringing back domestic production and the need for industrial facilities built with long steel. A booming residential and commercial construction market adds to the demand, requiring reinforcement for new buildings. Government policies like tariffs on imported steel further incentivize the use of American-made long steel products.

Technological advancements are producing lighter, stronger, and more corrosion-resistant long steel, making construction projects more efficient and potentially increasing demand further. While fluctuations in raw material prices and economic downturns could pose temporary challenges, the long-term outlook is bright. With infrastructure investment, a resurgent manufacturing sector, and a strong construction market, long steel products are well-positioned to be a vital building block for a stronger U.S. future.

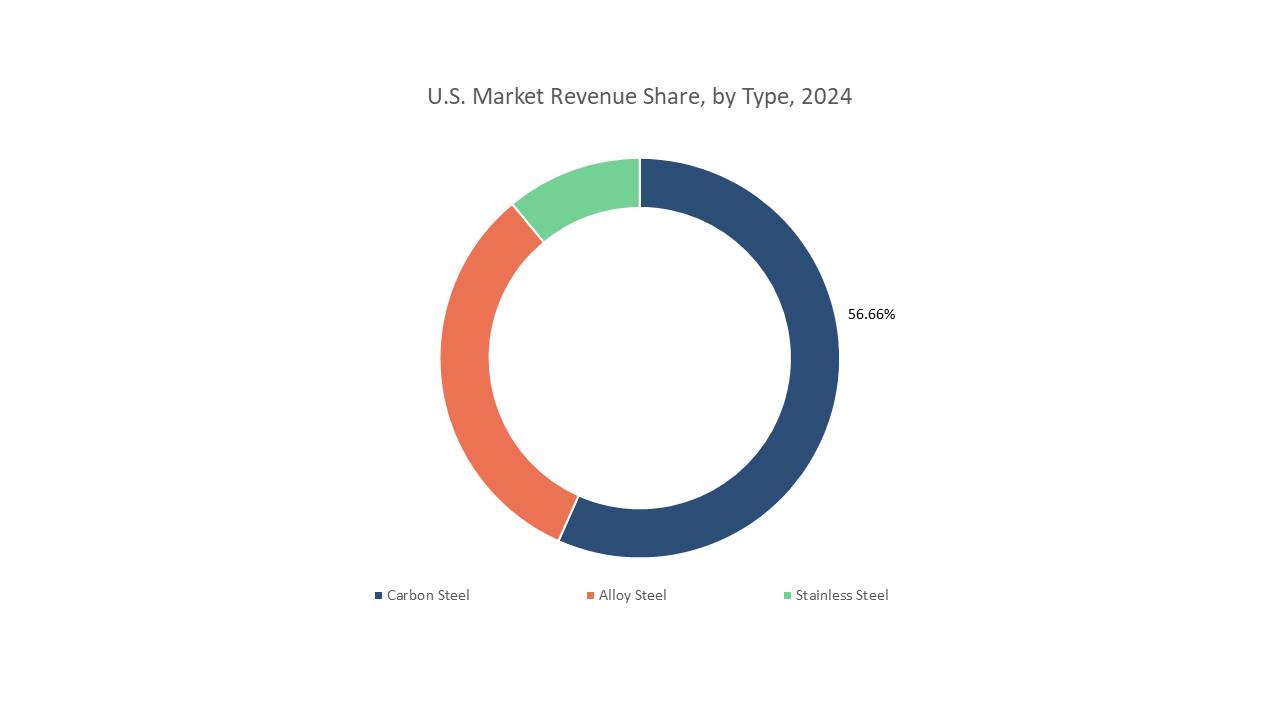

Type Overview

Carbon steel dominated the product segmentation across the global long steel products market in 2024 with a market revenue share of 60.72%. Carbon steel is experiencing a boom within the long steel products market. Its affordability makes it a budget-friendly choice for large-scale construction projects. Widely available and incredibly versatile, carbon steel forms the core of essential long steel products like rebar for reinforcement, wire rod for cables, merchant bars for structural support, and structural shapes for beams and bridges.

While not the greenest option, carbon steel's high strength allows for less material usage, reducing a project's environmental footprint. Additionally, it's one of the most recycled materials globally. Technological advancements are creating even stronger carbon steel varieties, making it even more efficient for long steel products.

Potential drawbacks include susceptibility to corrosion in harsh environments and raw material price fluctuations. However, the future for carbon steel remains bright. Its affordability, versatility, and widespread use make it a vital building block for the long steel products market, and continued advancements promise to solidify its position in this crucial sector.

Product Overview

Rebars dominated the product segmentation across the global long steel products market in 2024 with a market revenue share of 33.42%. Rebar, the backbone of reinforced concrete, is experiencing a surge in demand within the long steel products market. Fueled by a global construction boom, rebar consumption is rising as cities expand and infrastructure projects ramp up. These projects, from towering buildings to sprawling transportation networks, rely heavily on rebar for strength and durability.

Rebar's unique advantages like high tensile strength, excellent bonding with concrete, and cost-effectiveness make it the go-to choice for reinforcement. Furthermore, advancements in rebar technology are leading to stronger and more corrosion-resistant options, further solidifying its position.

Building codes and safety regulations often mandate rebar use, ensuring consistent demand. While economic downturns or raw material price fluctuations could cause temporary slowdowns, the long-term future for rebar remains bright. The ongoing construction frenzy and its irreplaceable role in concrete reinforcement solidify rebar's dominance within the long steel products market.

End-use Overview

Building & Construction dominated the end-use segmentation across the global long steel products market in 2024 with a market revenue share of 45.53%. Long steel products are experiencing a red-hot demand surge in the building and construction industry. This growth is fueled by a perfect storm of factors. A global construction boom, driven by urbanization and a focus on infrastructure development, is creating a massive need for these essential building blocks.

From towering skyscrapers to sprawling transportation networks, long steel products like rebar are in high demand due to their cost-effectiveness, versatility, strength, and recyclability. Technology is further fueling this fire with the development of high-strength and corrosion-resistant steel, while government policies promoting infrastructure and sustainable construction practices are adding fuel to the tank.

While fluctuations in raw material prices and economic downturns could pose temporary challenges, the long-term outlook for long steel products in construction remains bright. Their unique advantages, coupled with the ongoing building boom and supportive government policies, solidify their position as vital building blocks for the future.

Market Characteristics

The long steel products market, a vital cog in the construction and infrastructure machine, is a fiercely competitive arena. Global giants like ArcelorMittal and Nippon Steel share the space with established regional players such as Tata Steel and Severstal. Competition hinges on several factors.

Cost efficiency, with access to cheap raw materials and efficient production, is a major advantage. Similarly, companies offering high-quality, innovative products like high-strength or corrosion-resistant steel can stand out. A strong global presence with established distribution networks allows companies to tap into new markets and cater to a wider customer base.

With growing environmental concerns, companies with a focus on sustainable steel production and responsible waste management are gaining a competitive edge. Navigating complex government regulations across different markets is another hurdle companies need to overcome. The future holds exciting opportunities. Developing economies with booming infrastructure projects present new markets.

Global Long Steel Products Market Report- Scope (Customizable)

Scope |

Description |

|

Historic Period |

2018-2023 |

|

Base Year (Esti.) |

2024 |

|

Forecast Period (F) |

2024-2032 |

|

Market Revenue |

USD Million |

|

Market by Type |

Carbon Steel, Alloy Steel, and Stainless Steel |

|

Market by Product |

Rebars, Sections, Tubes, Rail, Merchant Bars, and Others |

|

Market by End-use |

Building & Construction, Automotive & Aerospace, Railways & Highways, Industrial, and Others |

|

Market by Region |

North America (NA), Europe (EUR), Asia Pacific (APAC), Central & South America (CSA), and Middle East & Africa (MEA) |

|

Countries Covered |

U.S., Canada, Mexico; Germany, UK, Italy, France, Spain, Russia; China, India, Japan, South Korea, Malaysia, Singapore, Thailand, Vietnam, Australi & New Zealand; Brazil, Argentina; Saudi Arabia, United Arab Emirates (UAE), Iran, South Africa |

GET A FREE SAMPLE

GET A FREE SAMPLE

Need a custom report?

Need a custom report?