Aircraft Landing Gears Market

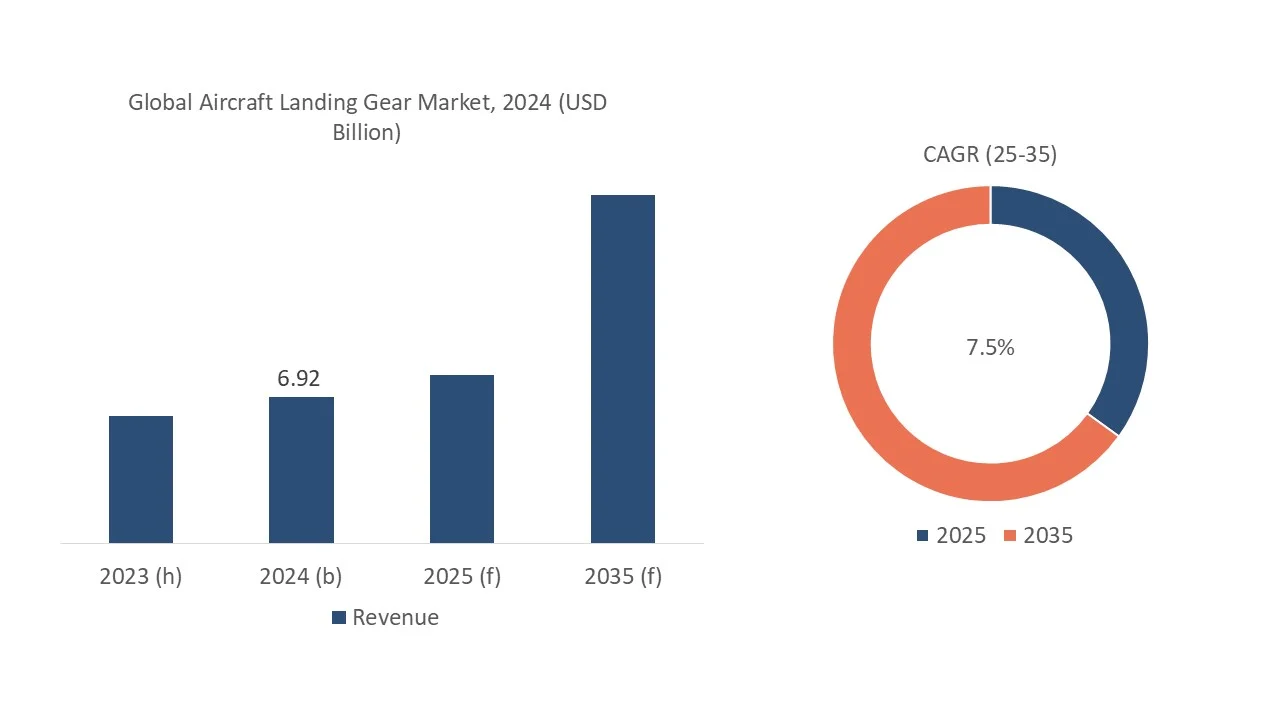

According to Novatrends Market Intelligence, the global aircraft landing gears market was valued at USD 6.92 billion in 2024 and is anticipated to propel at a growth rate of 7.5% from 2025-2035.

The aircraft landing gears market is primarily driven by the growing global demand for both commercial and military aircraft. As air passenger traffic continues to rise, particularly in emerging economies, airlines are expanding their fleets, fueling the demand for new aircraft and, consequently, landing gears.

The market is also benefiting from the increase in defense budgets worldwide, where governments are investing in advanced military aircraft, further driving demand. Technological advancements play a crucial role, with innovations such as lightweight materials like titanium and carbon composites reducing aircraft weight and enhancing fuel efficiency, which appeals to manufacturers looking to improve overall performance.

Additionally, the growing focus on aircraft modernization and replacement programs boosts the need for next-generation landing gear systems designed to offer better durability, safety, and reliability in various operating conditions. The rise of low-cost carriers and the expansion of air travel in regions like Asia-Pacific and the Middle East have further bolstered the need for new aircraft. Moreover, stringent government regulations related to passenger safety and the need for landing gears that can withstand extreme weather and diverse landing conditions push manufacturers to develop more resilient and efficient systems, thus driving growth in the market.

Aircraft Landing Gears Market Recent Developments

Aircraft landing gears market is anticipated to propel at a compounded annual growth rate (CAGR) of 7.5% from 2025-2035. Recent developments in the aircraft landing gears market reflect a combination of technological advancements, strategic partnerships, and regulatory adaptations.

Aircraft Landing Gears Market is highly competitive due to the presence of major market players actively engaged in implementing strategic initiatives such as increasing investments, new product launches, merger & acquisitions, and others. For instance,

- In March 2024, Patria and Lockheed Martin have signed a Memorandum of Agreement for the production and delivery of landing gear doors for the F-35. This long-term contract involves the manufacturing of 400 sets of F-35 landing gear doors and represents a significant enhancement to Patria’s future capabilities. Additionally, the expertise gained from working with F-35 materials, particularly in relation to the F-35 Forward Fuselage Assembly, is crucial for ensuring Finland’s security of supply.

- In February 2024, Liebherr-Aerospace and Japan Airlines (JAL) have entered into a long-term service contract for the overhaul of landing gears. Under this agreement, Liebherr-Aerospace will serve as the exclusive service provider for J-Air, a subsidiary of the JAL Group, responsible for the maintenance, overhaul, and repair of landing gears for the airline’s E170 and E190 fleet.

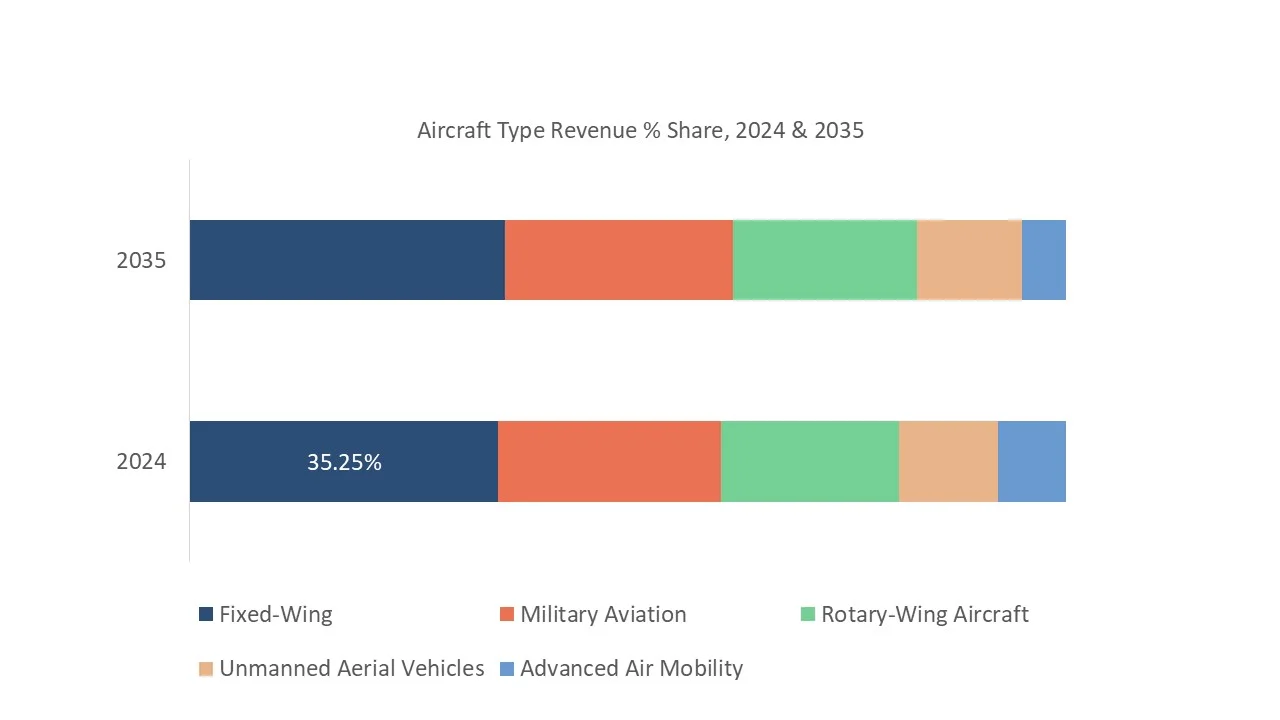

Regional Overview

North America dominated the global aircraft landing gears market in 2024 with a market revenue share of 35.25%. The North America aircraft landing gears market is driven by several key factors, primarily the region’s strong presence in both commercial and military aviation. The U.S. is home to major aircraft manufacturers such as Boeing and Lockheed Martin, which consistently produce a high volume of commercial and defense aircraft, fueling the demand for landing gear systems.

The growing focus on sustainability in aviation, along with regulations aimed at reducing carbon emissions, is pushing manufacturers to innovate in landing gear design. The increasing demand for regional jets and narrow-body aircraft, coupled with significant investments in aircraft modernization and replacement programs, enhances the need for advanced landing gear systems.

The defense sector also plays a major role, with rising military budgets driving the production of advanced fighter jets, drones, and other military aircraft. Moreover, the region’s expansive air travel network and rising passenger traffic, particularly in the U.S. and Canada, add to the demand for new and more efficient aircraft, further propelling the market for landing gears.

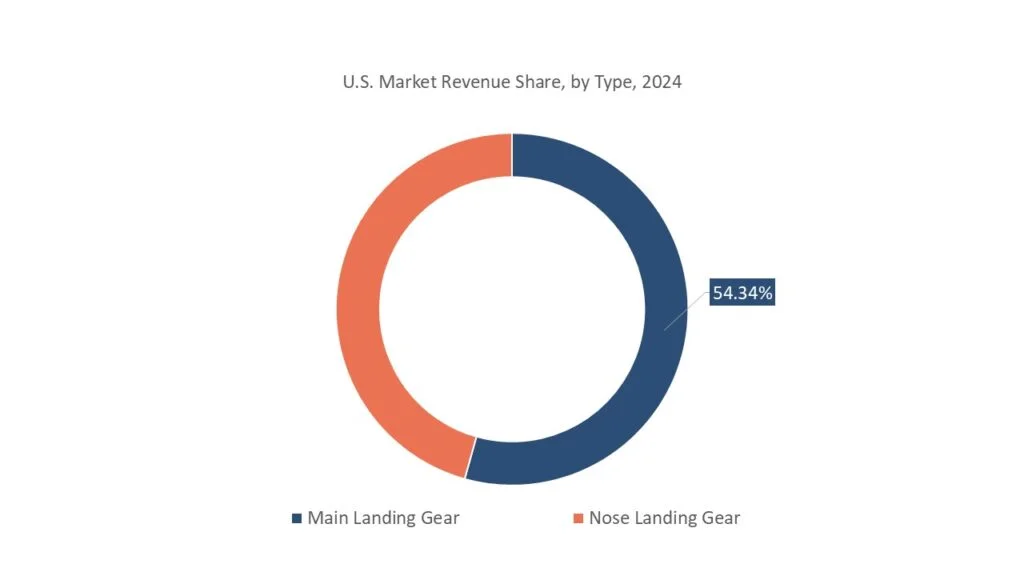

U.S. Aircraft Landing Gears Market Overview

The U.S. aircraft landing gears market is driven by several critical factors, primarily the country’s dominance in both commercial and military aviation. As home to leading aerospace manufacturers such as Boeing, Lockheed Martin, and Northrop Grumman, the U.S. consistently produces a high volume of aircraft, driving the demand for landing gear systems.

The growing need for fuel-efficient, lightweight aircraft is a major driver, with advancements in landing gear technology focusing on materials like carbon composites and titanium, which reduce overall weight and enhance fuel economy. Increasing investments in military aviation, supported by a substantial defense budget, fuel the demand for landing gears in advanced fighter jets, unmanned aerial vehicles (UAVs), and other military aircraft.

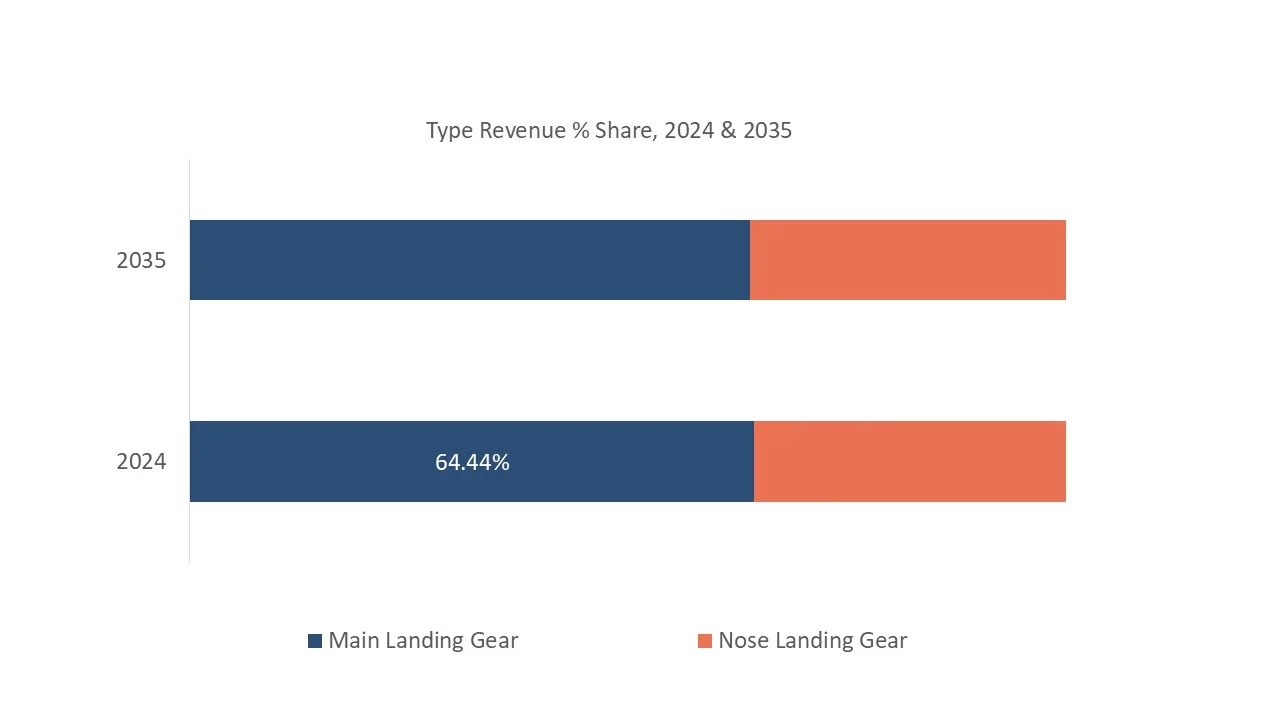

Type Overview

Main landing gear dominated the Type segmentation across the global aircraft landing gears market in 2024 with a market revenue share of 64.44%. The main drivers of the aircraft landing gears market include the growing demand for new aircraft, driven by increasing air passenger traffic and fleet expansion across both commercial and military aviation.

Airlines are investing in next-generation, fuel-efficient aircraft, leading to a higher demand for advanced landing gear systems that offer reduced weight, improved durability, and better fuel efficiency. Technological advancements, such as the use of lightweight materials like composites and titanium, along with innovations in landing gear actuation systems, are also key factors boosting market growth.

Additionally, the rise in aircraft modernization and replacement programs, coupled with stringent safety regulations, is pushing manufacturers to develop more reliable and efficient landing gear systems. The growth of the low-cost carrier market, particularly in emerging regions, and increasing investments in defense aircraft and unmanned aerial vehicles (UAVs) further contribute to the demand for advanced landing gear solutions.

Aircraft Type Overview

Fixed-Wing dominated the Arrangement segmentation across the global aircraft landing gears market in 2024 with a market revenue share of 35.25%. The fixed-wing aircraft landing gears market is characterized by a diverse range of designs and technologies tailored to meet the specific needs of various aircraft types, including commercial airliners, military planes, and general aviation.

Fixed-wing landing gears typically feature either tricycle or tailwheel configurations, with tricycle gear being predominant in modern commercial aviation due to its stability during takeoff and landing. The market emphasizes safety, reliability, and performance, as landing gears must endure significant stress and impact during landing phases.

Technological advancements, such as the integration of lightweight materials like composites and advanced hydraulic systems, enhance fuel efficiency and reduce maintenance costs. Moreover, the market is influenced by the increasing demand for regional and narrow-body aircraft, particularly in emerging markets, where air travel is on the rise. Stringent safety regulations from organizations like the FAA and EASA require manufacturers to ensure that landing gear systems comply with high-performance standards.

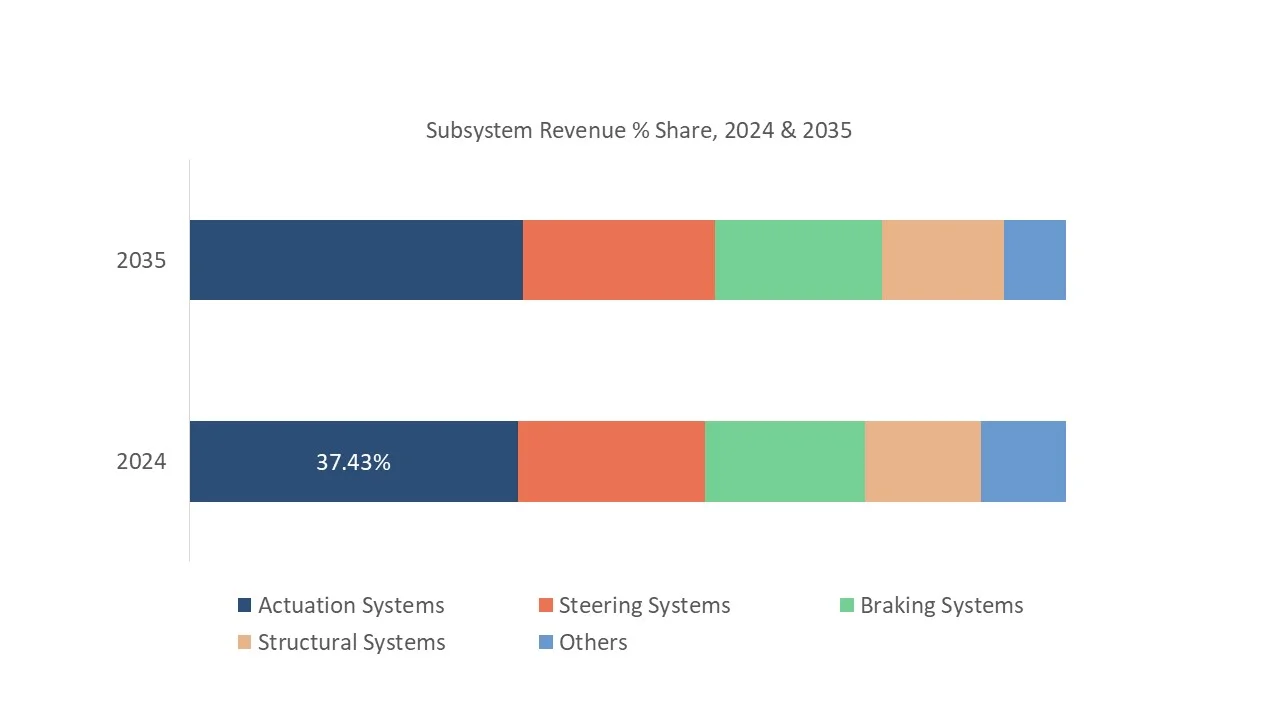

Subsystem Overview

Actuation Systems dominated the Subsystem segmentation across the global Aircraft Landing Gears Market in 2024 with a market revenue share of 37.43%. The actuation systems in the aircraft landing gears market are driven by the increasing demand for efficient and reliable landing gear mechanisms in modern aircraft. As airlines seek to improve fuel efficiency and reduce maintenance costs, the shift towards advanced actuation systems, such as electro-mechanical and electro-hydraulic systems, is gaining momentum.

Technological advancements, including smart sensors and automation, are further driving the demand for sophisticated actuation systems that enhance safety and operational efficiency. The growing trend of aircraft modernization and the replacement of aging fleets also contributes to the increased demand for cutting-edge actuation technologies. Additionally, the rise of unmanned aerial vehicles (UAVs) and electric aircraft in both military and commercial sectors is spurring the need for advanced landing gear actuation systems designed for precise and reliable operation in diverse environments.

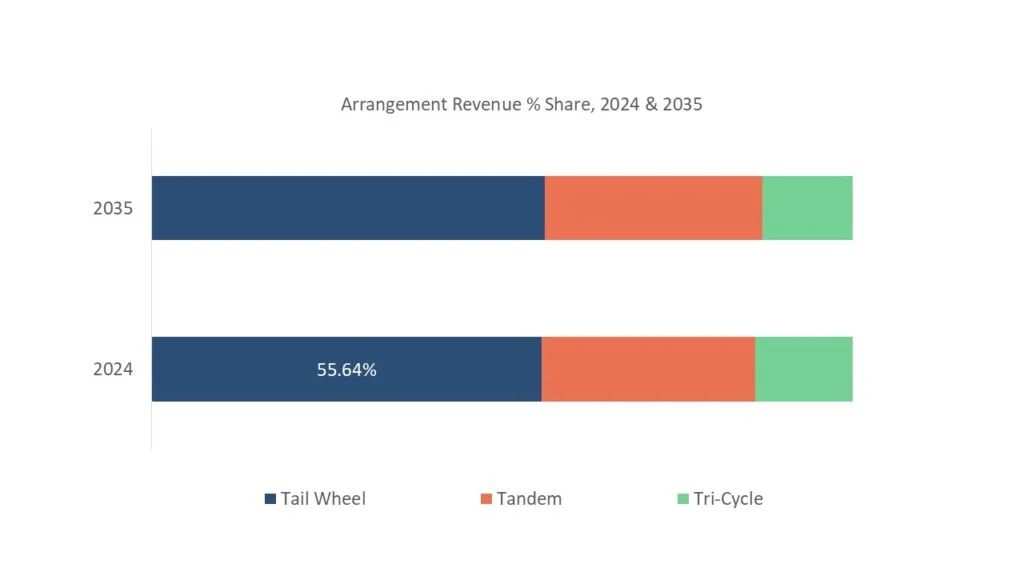

Arrangement Overview

Tail Wheel dominated the Arrangement segmentation across the global aircraft landing gears market in 2024 with a market revenue share of 55.64%. The tail wheel aircraft landing gears market is driven by several factors, particularly the growing demand for lightweight, rugged aircraft used in challenging environments such as bush flying, agricultural operations, and recreational aviation.

This capability has increased their use in utility and bush planes, where robust performance in off-airport operations is critical. The rising popularity of taildraggers among aviation enthusiasts, especially in sport, aerobatic, and vintage aircraft communities, further boosts market demand. Additionally, advancements in materials and technology are improving the durability, safety, and performance of tail wheel landing gears, making them more attractive to modern aircraft manufacturers.

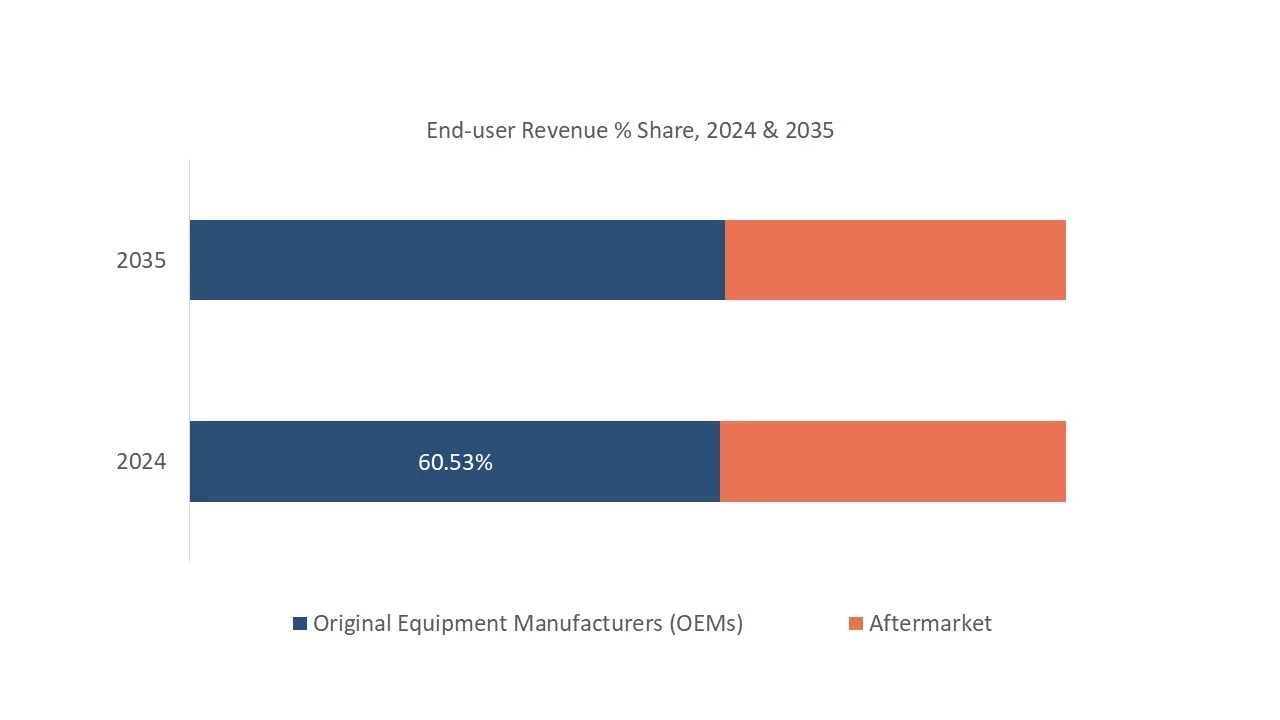

End-users Overview

Original Equipment Manufacturers (OEMs) dominated the End-user segmentation across the global aircraft landing gears market in terms of market revenue with a market share of 60.53% in 2024. The aircraft landing gears market for Original Equipment Manufacturers (OEMs) is driven by the rising demand for new, fuel-efficient aircraft, as airlines expand their fleets to accommodate growing air passenger traffic.

Increasing investments in aircraft modernization and replacement programs, especially in the commercial and defense sectors, further drive the demand for advanced landing gear systems. Additionally, stringent safety and performance regulations require OEMs to continually innovate, offering more durable, reliable, and efficient landing gear solutions. The growth of low-cost carriers and regional jets, particularly in emerging markets, adds to the demand for OEM landing gear systems.

Market Characteristics

The aircraft landing gears market is characterized by its focus on safety, reliability, and technological innovation, driven by the need to withstand varying operational conditions during takeoff, landing, and taxiing. It is highly influenced by advancements in lightweight materials such as carbon composites and titanium, which enhance fuel efficiency and reduce maintenance costs.

The market serves both commercial and military aviation sectors, with demand driven by fleet expansion, aircraft modernization programs, and rising air travel. Stringent safety regulations and performance standards set by aviation authorities like the FAA and EASA further shape the market, requiring continuous innovation. The sector is also seeing growth due to the rise of low-cost carriers and increased demand for regional and narrow-body aircraft, particularly in emerging economies. Durability, cost-effectiveness, and sustainability are key characteristics influencing product development in this market.

Global Aircraft Landing Gears Market Report- Scope (Customizable)

| Scope | Description |

|---|---|

| Historic Period | 2018-2023 |

| Base Year (Esti.) | 2024 |

| Forecast Period (F) | 2025-2035 |

| Market Volume | Kilotons |

| Market Revenue | USD Million |

| Market by Type | High Calcium Limestone and Magnesian Limestone |

| Market by Size | Crushed, Calcined (PCC), and Ground (GCC) |

| Market by Application | Industry Lime, Chemical Lime, Construction Lime, Refractory Lime, and Others |

| Market by End-use | Building & Construction, Metallurgy, Pulp & Paper, Chemical, Wastewater Treatment, Agriculture, and Others |

| Regions Covered | North America (NA), Europe (EUR), Asia Pacific (APAC), Central & South America (CSA), and Middle East & Africa (MEA) |

| Countries Covered | U.S., Canada, Mexico; Germany, UK, Italy, France, Spain, Russia; China, India, Japan, South Korea, Malaysia, Singapore, Thailand, Vietnam, Australi & New Zealand; Brazil, Argentina; Saudi Arabia, United Arab Emirates (UAE), Iran, South Africa |

PDF

PDF  GET A FREE SAMPLE

GET A FREE SAMPLE

Need a custom report?

Need a custom report?